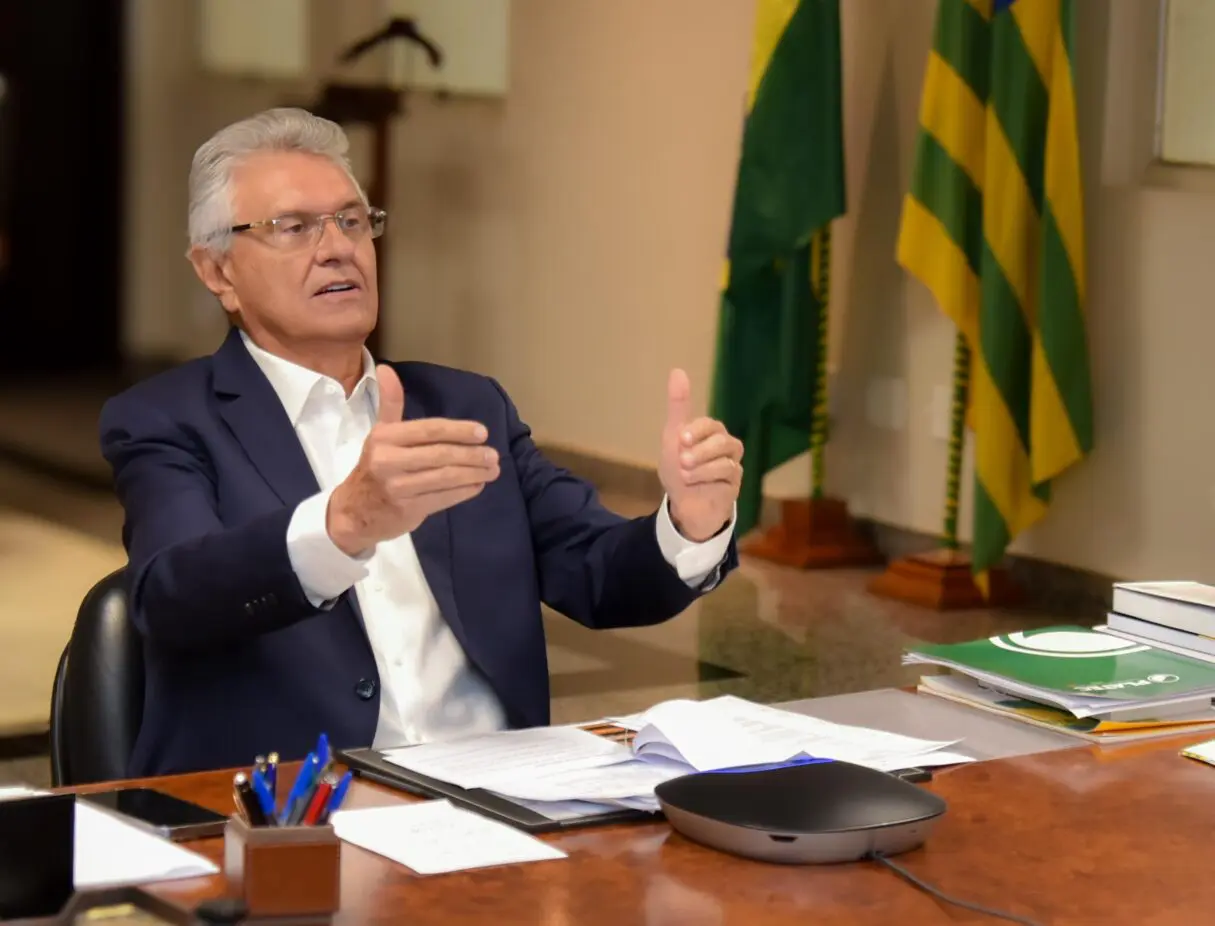

TAX REFORM: About to be voted on in the Senate, regulation is seen as complex and impractical by Governor Caiado

One of the main criticisms is the Tax on Goods and Services, the IBS — which will be the unification of the current ISS and ICMS collected by states and municipalities. And for Caiado, it is “something impossible to be applied”. The governor understands that “a change that involves more than 5,500 city halls from 26 states and one Federal District cannot be made within a constitutional amendment, which states that the prerogatives of governors will be secondary and that a management committee will deliberate on the sharing of the revenue between municipalities and states.”

“Super powerful” steering committee

To manage the IBS — a tax collected by states and municipalities — the IBS Management Committee will be created. This is a committee that will collect taxes, offset debts and credits, and distribute revenues to the entities. And, in Caiado’s opinion, the representative of this committee “will have more power than the governor,” he complains.

“He is the one who will tell the governor: your monthly allowance will arrive tomorrow and it will be so many millions of reais. I presented a government plan, I was elected, I found a bankrupt state, in debt, that could not take out loans, and today Goiás is a state with fiscal balance, it has progressed, it has cash in hand, it has investment, it has health and education. And then I will have to govern with a monthly allowance”, assesses the governor of Goiás.

Tax lawyer and partner at Toledo Marchetti Advogado, Luis Claudio Yukio Vatari, agrees with Caiado’s thinking, evaluating the economic situation of the state he represents.

“He is in a state that will possibly be greatly impacted by his own revenue, he will depend heavily on transfers, which is why I agree with what he says on this issue.”

Fights in court

Another criticism from Caiado concerns the legal actions resulting from the IBS. For him, “it will be the biggest judicialization ever seen in the world when the IBS starts to operate. We will have the 5,568 municipalities and the 26 states plus the Federal District with actions in the Supreme Federal Court”, he predicts.

“They will complain about the amount of revenue transferred, they will claim that some earn more than others, they will question the responsibility of the management committee. I think this government proposal is unfortunate, it concentrates on Brasília, it takes away 100% of the representation, management and governance capacity of governors and mayors and transfers it to what I initially called the ‘Venezuelan Committee’. The distribution of R$1 trillion will simply be in their hands. Whoever manages the committee will have the most important position in the country”, says Caiado.

Lawyer Yukio Vatari agrees that there will be an increase in lawsuits and criticizes the model that was used for the IBS basis.

“We took the most complex tax, which is the ICMS, and we are using it as a model to do everything. Here in my office, we already have theses prepared for clients even without having the legislation ready. And it is not just my office, most of the offices that work with tax (reform) have already seen failures, abuses and other procedural issues with Congress.”

The substitute text is in the Senate and should begin to be considered when it returns from recess, now in August. Regarding the possible changes that the text could undergo in the Senate, Caiado states that “after the approval of the PEC (in December 2023), these changes are merely accessories and will not alter the consequences that have already been implemented in terms of real consequences for the population. There is no point in trying to treat an exposed fracture with a band aid.”

By Brasil 61